It is a simpler, easier, and more effective alternative to traditional budgeting.

And I struggled to find anything that worked for Linda and I until we discovered the Real Money Method. Long story short, I have been testing out budgeting apps, software, and spreadsheets for the last 13 years (I know pretty nerdy).

Household budget excel free#

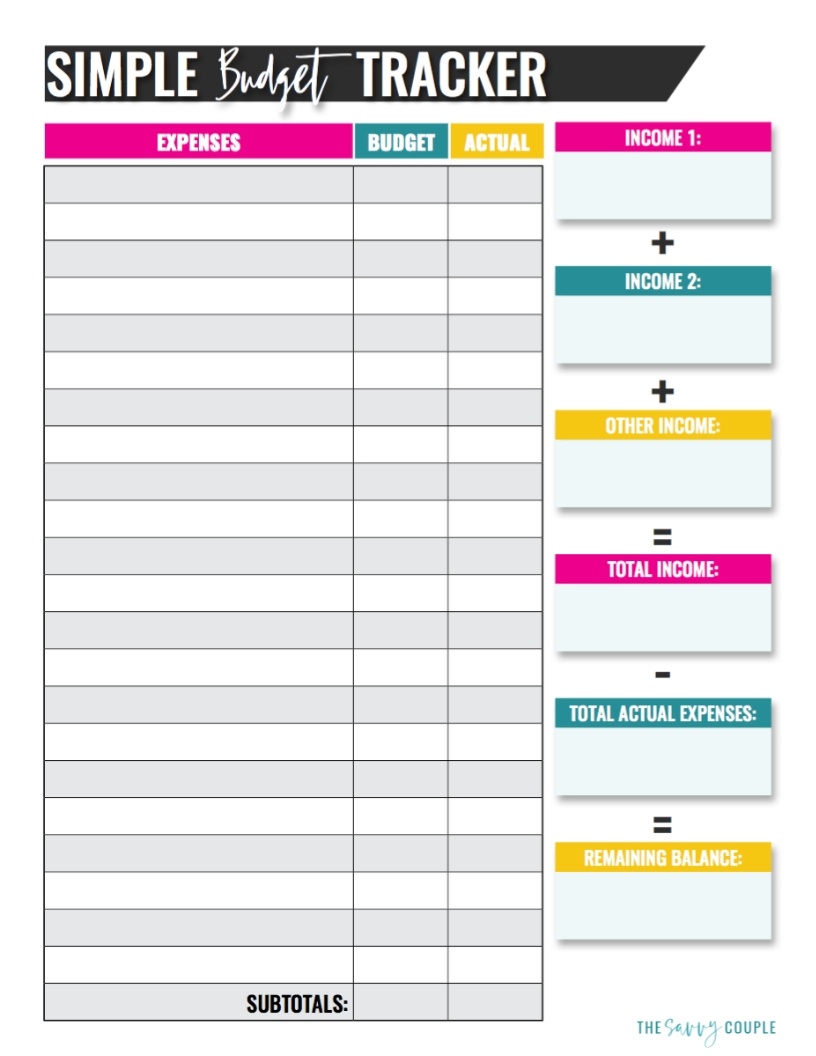

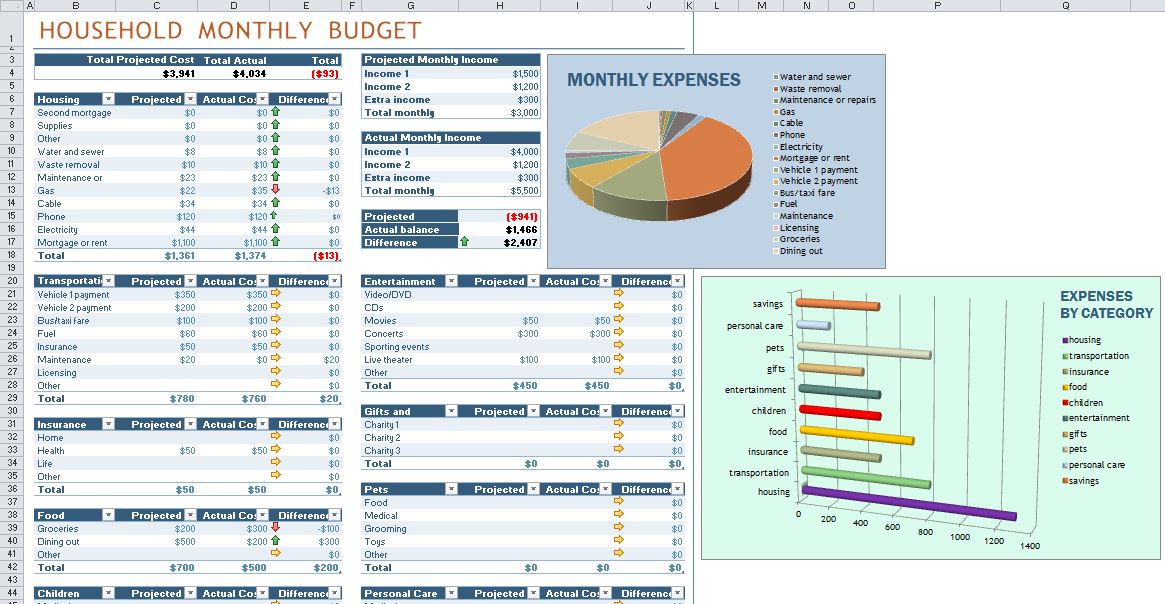

If you have a spreadsheet that you have built or have found (that is free to distribute) please provide a link to it in the comments below. Some may also work with Google Docs, but I have had bad luck with some of my imports into Google Docs.Įach of the budgeting sheets below have their own strengths and weaknesses, so give try them out, see what works, and make tweaks and changes if necessary. Instead of creating one, for a pity purpose of expense management, you can get hundreds of free and different excel daily household budget expense tracking templates.But whether you like to create spreadsheets or just like to use them, we have a lot of good options for you!Įach one of the sheets below are free and are designed to be used with Excel, but will more than likely work if you use OpenOffice (basically a free version of Microsoft Office). Get Free Template, Use Comment Section & Mention Your Email Let’s Expand The Template Monthly Take-Home Income Upon the unnecessary addition and increment in the amount, you can check if there is anything useless which you can cut down. You can easily enter the total cash reserve for the month and devise proportional amounts to these activities which give a summation as daily’s total expense. These templates are finely composed of various categories of daily activities like vacation trips and the formulated segments for the total amount you have in hand. MS Excel is one best opportunities to manage all these complicated matters of expenses and budget monitoring using expense budget spreadsheet templates.

Household budget excel how to#

Now the question may arise about how to categorically arrange wide scattered expense lists and making a structured net to understand and monitor the intensity of expense?įor any kind of modern approach of management which includes complicated analytical submissions, you require some assisting tools like budget planner application. Dividing the total monthly costs on a daily basis helps you understand the structure of money spending.

In case you have a made or servant on daily wages, that’s an additional entity in your budget.īy splitting up, you can visualize the expense occurring for individual activities and you can easily monitor the right purposes and wrong ones to control unnecessary resource utilization. Which are important to bear rather than ignoring and paying an even higher cost, collectively constitute the daily expense. All these allied expenses which include your monthly educational expenses, daily hung out plans, family maintenance, and accidental expenses. There are multiple utilities in your life for which you pay monthly or weekly. Usually, the charges of regular life days are the daily household expenses which include the cost of traveling, grocery, and kitchen, utilities like electricity, fuel, telecommunications, and others.ĭistributing the entire monthly cost of each particular activity into days makes it easier for you to keep a track.

0 kommentar(er)

0 kommentar(er)